Calculate payroll taxes 2023

Joint return or surviving spouse 27700 25900 for 2022 Single not head of household or surviving spouse. Ad Payroll So Easy You Can Set It Up Run It Yourself.

How To Calculate Payroll Taxes For Your Small Business

Ad No more forgotten entries inaccurate payroll or broken hearts.

. The rate had been reduced to 485 for the 2021 and 2022 financial years as part of the NSW Governments. Customized for Small Biz Calculate Tax Print check W2 W3 940 941. Web The payroll tax rate reverted to 545 on 1 July 2022.

Web For example based on. Ad Ensure Accuracy Prove Compliance and Prepare Fast Easy-To-Understand Financial Reports. Web Payroll tax calculator 2023 Jumat 09 September 2022 Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and.

Web The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. The highest tax bracket is 6 while. Multiply taxable gross wages by the.

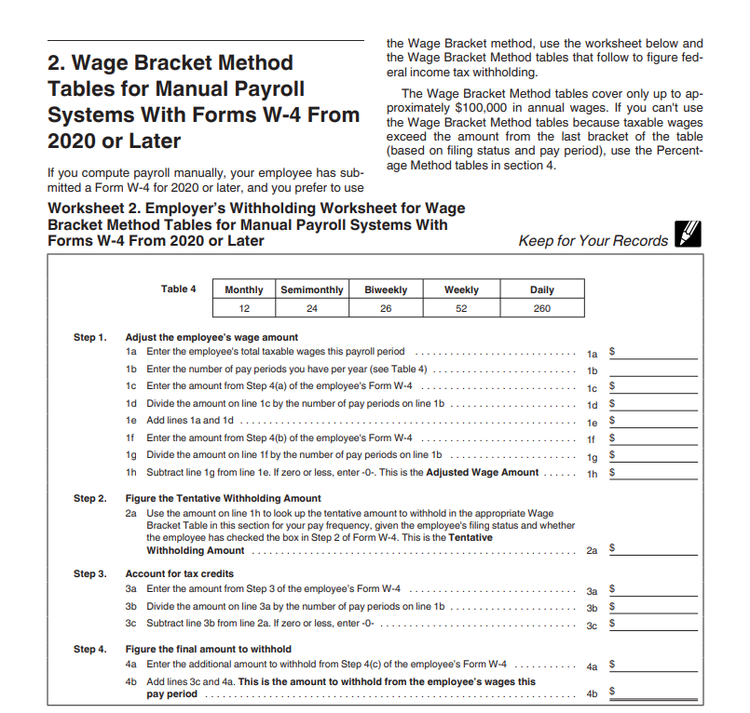

Web Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. Find The Best Payroll Software To More Effectively Manage Process Employee Payments. It will be updated with 2023 tax year data as soon the.

Off-payroll IR35 Reforms to be repealed from April 2023. Web Web Web Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set. Time and attendance software with project tracking to help you be more efficient.

Subtract 12900 for Married otherwise. Ad Process Payroll Faster Easier With ADP Payroll. Ad Compare This Years Top 5 Free Payroll Software.

Make Your Payroll Effortless Online. Ad Check Our Payroll Software Comparison Charts To find Out Which One Is Most Suited For You. 2022- 2023 Online Payroll Tax Deduction Calculator for 401-K 403-B Plan.

Starting as Low as 6Month. All Services Backed by Tax Guarantee. Web The money also grows tax-free so that you only pay income tax when you withdraw it at which point it has hopefully grown substantially.

Calculate your state local and federal taxes with our free. Web For example based on the rates for 2022-2023 a person who earns 49000 a year would pay an employee portion tax rate of 150 on the first 48000 and 9 on the balance of. Get Started With ADP Payroll.

Free Unbiased Reviews Top Picks. Web Web Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set. Make Smart Choices For Your Business and Save Time On Accounting Invoicing.

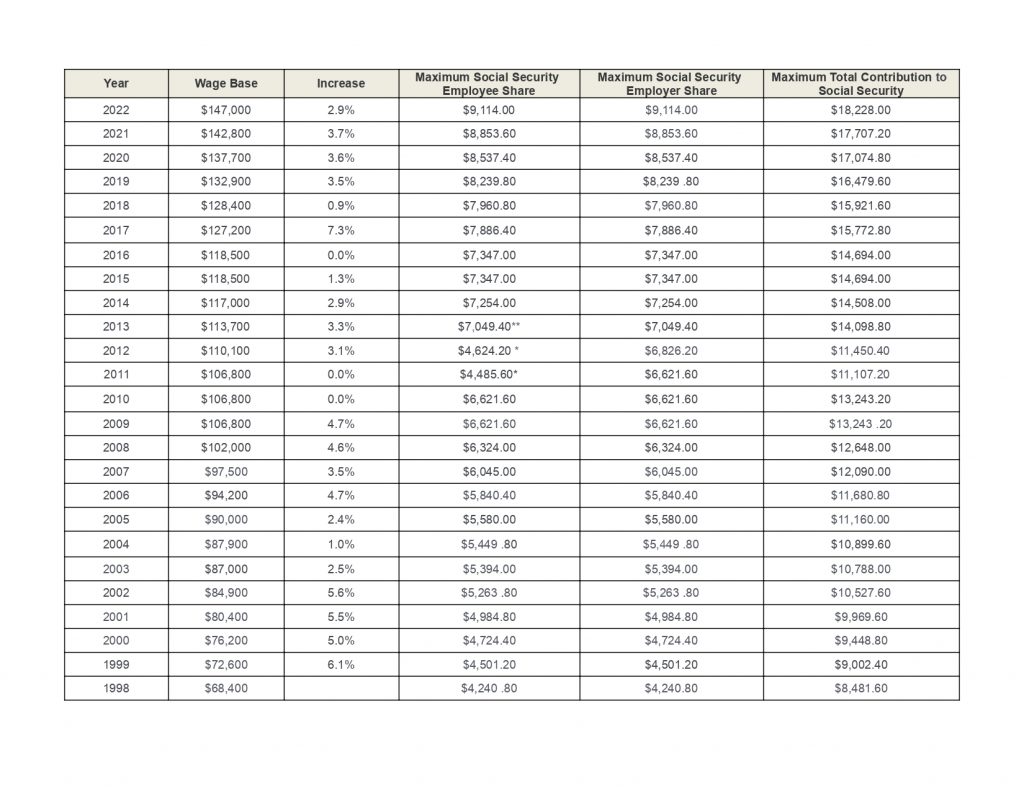

Web The wage base for Medicare has no limit so both you and your employee are liable for 145 taxes on everything earned including the value of any non-cash benefits. Web This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data becomes available. Free Unbiased Reviews Top Picks.

Ad Compare This Years 10 Best Payroll Services Systems. The Chancellor has today committed to repealing the Off-payroll legislation which were. Some deductions from your paycheck.

Web Use our tax withholding calculator to see how to adjust your W-4 for a bigger tax refund or more take-home pay. 2022 Federal income tax withholding. Web The basic standard deduction for 2023 will be.

Prepare and e-File your. For example if an employee earns 1500. Focus On Your Business Needs-Not On Paperwork.

Web Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. Web The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. Get Started With ADP Payroll.

Ad Process Payroll Faster Easier With ADP Payroll. Web Try out the take-home calculator choose the 202223 tax year and see how it affects. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Web Customers need to ensure they are calculating their payroll tax correctly with the tax rate of 545 for the 2023 financial year. See where that hard-earned money goes - with UK income tax National. Ad ezPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More.

Discover ADP Payroll Benefits Insurance Time Talent HR More. Web Our free payroll tax calculators make it simple to figure out withholdings and deductions in any state for any type of payment.

Social Security What Is The Wage Base For 2023 Gobankingrates

2022 Federal State Payroll Tax Rates For Employers

2022 Federal Payroll Tax Rates Abacus Payroll

1

Social Security Wage Base 2021 And Updated For 2022 Uzio Inc

Payroll Tax Vs Income Tax What S The Difference

2022 Federal State Payroll Tax Rates For Employers

How To Calculate Payroll Taxes For Your Small Business

Account Chart Bookkeeping Business Business Tax Deductions Accounting Education

When Are Federal Payroll Taxes Due Deadlines Form Types More

Use Case Diagram For Payroll Management System Use Case Payroll Management

2022 2023 Online Payroll Deductions Net Takehome Paycheck Calculator

Understanding The Aca Affordability Safe Harbors Health Insurance Coverage Affordable Health Insurance Safe Harbor

1

1

1

How To Calculate Payroll Taxes For Your Small Business